Metal Buildings For Sale

Let Us Help You Save

Get wholesale pricing and save up to 33%

customize your structure

Popular Sizes

Commercial Structures

Car Wash Buildings

A car wash can be a lucrative business. But here’s the thing—it is not a business you can enter lightly. If you are looking to start up a company on…

Police Department Building Architecture & Design

Are you in charge of hiring an architect to help you design a police station? While many police stations are incredibly basic, some are works of functional art. In this…

Mechanic Shop Building Kits

If you need to build a mechanic shop, one of the easiest and more affordable options is to get a metal building kit. In this post, we are going to…

Airplane Hangar Kits

Whether you have a small private plane or multiple commercial aircraft, your airplanes deserve the best possible protection while they are on the ground. We are going to go over…

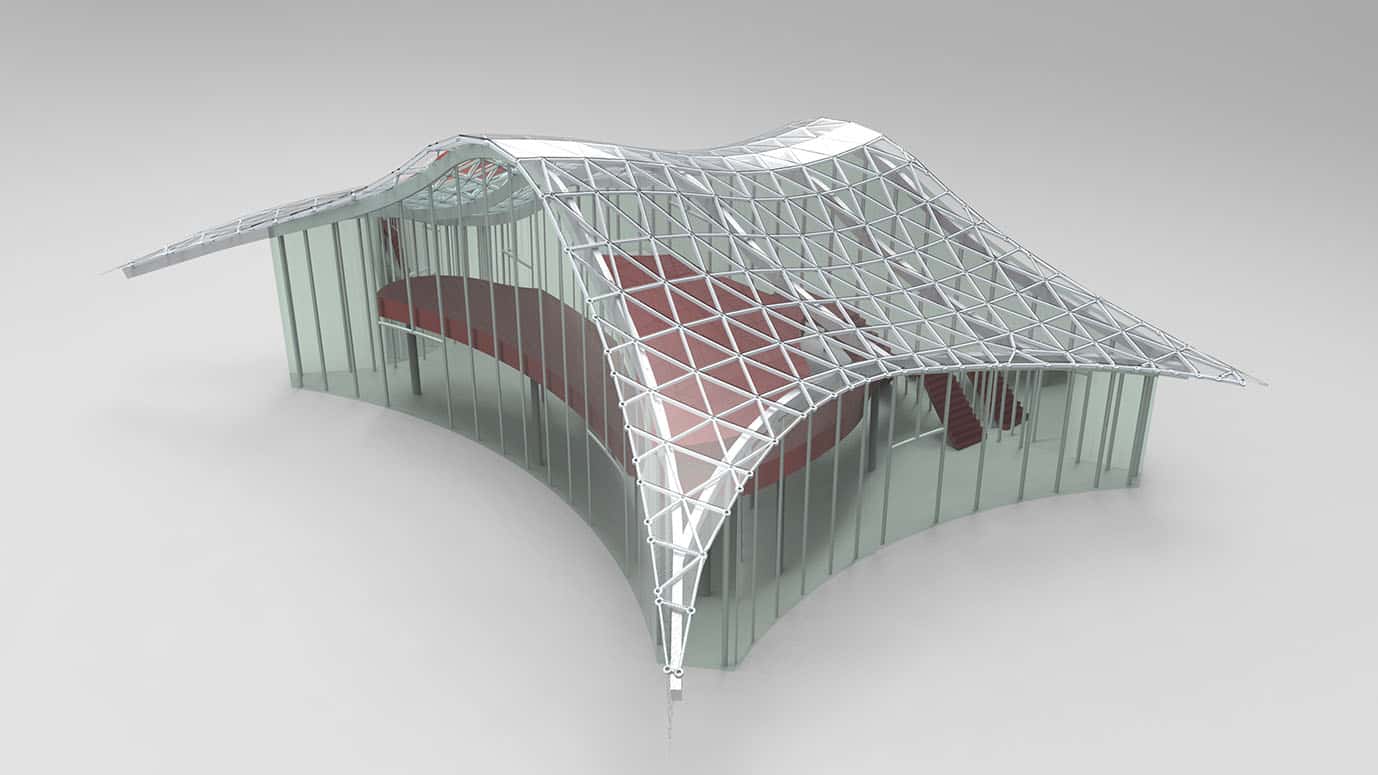

Space Frame Structures

Architects are turning to space frame structures when the goal of a building is to offer large, open spaces that have very few interior supports. Fewer interior supports allow the space…

Hoop Buildings / Fabric Barn Kits & Uses

If you’re looking for an affordable, easy-to-build metal structure, a hoop building may be an excellent option for you. Their rounded design makes them similar to a Quonset hut, but…

Metal Storage Units & Self Storage Buildings

Few businesses are as lucrative or dependable over the long term as self-storage. If there is one thing people are always going to need, it is more space. If you…

Metal Greenhouse Kits

Having a greenhouse gives you a specific type of freedom. It gives you the space and ability to grow the plants you want any time of year. If you enjoy…

Church Building Designs

Churches are more than just places of worship; they also serve as places for the congregation to gather, socialize, learn and more. Metal buildings are ideal for this purpose because…

RV Garage Plans

If you own a recreational vehicle and do not use it fulltime, you need somewhere safe to park it over the rest of the year. For some, they rent an…

Agricultural Farm Buildings

If you need to construct a dairy barn, equipment storage facility, or other agricultural building, a metal farm building can provide you with the durability and versatility you need at…

Residential Buildings

Hunting Cabin Kits

Hunting cabins offer an ideal retreat for outdoor enthusiasts looking for a comfortable and functional space to rest during hunting trips. These cozy, inviting structures provide shelter and relaxation after…

Man Cave Ideas

Sometimes you just need some time and space to yourself. You want to pursue your own interests and decompress. A man cave offers you a place that is all your…

Shipping Container Workshops

Shipping containers are a popular, economical choice for people building homes or offices. Durable, long-lasting and affordable, containers can be converted into a functional space used for both residential and…

The Ultimate Guide To Shipping Container Homes

Tiny houses and metal homes are both huge trends right now in residential home designs. At the intersection between the two are shipping container homes. If you’ve seen some photos…

SHouse (Shop House) 101

Are you a woodcrafter, potter, mechanic, or other type of craftsman? If so, a traditional residence can severely limit the possibilities with your workshop. In fact, you might even end…

Barndominiums Ultimate Guide

While looking into different types of metal buildings for your residential construction project, you probably have noticed that a new type of metal barn house called a barndominium that seem…

Metal Building Homes & Prefab Kits

Compare Quotes From Licensed Contractors In Your State Save Up To 40% Of The Same Kit As Sold Direct From The Manufacturer Request Your Quote Free Quote Chances are good…

Garage Kits

If you have been thinking about adding a garage to your property, you can build one yourself using a metal garage kit rapidly and affordably. Let’s consider the benefits of…